2 min read

The Role of Technology in Sales Enablement for Financial Services

Ty Spalding : August 7, 2024 at 8:08 AM

Sales enablement has become a critical component for success. Financial services companies are increasingly turning to technology to enhance their sales processes, improve client interactions, and stay competitive. Let's explore how technology is transforming sales enablement in the financial services sector and the key benefits it brings to the table.

Understanding Sales Enablement

Sales enablement involves providing the sales team with the necessary tools, resources, and training to effectively engage and convert prospects. It encompasses a wide range of activities, including content creation, training programs, and performance analysis. For financial services, where the products are often complex and the regulatory environment is stringent, sales enablement is crucial for driving growth and ensuring compliance.

The Technological Transformation

1. CRM Systems: Centralizing Client Information

Customer Relationship Management (CRM) systems are at the heart of sales enablement. They centralize client data, track interactions, and provide valuable insights into customer behavior. For financial advisors, having access to a comprehensive CRM allows for personalized service, timely follow-ups, and a deeper understanding of client needs. By leveraging CRM technology, financial institutions can streamline their sales processes and improve client satisfaction.

2. AI Learning: Predictive Insights

Artificial Intelligence (AI) is revolutionizing sales enablement by offering predictive analytics and insights. This technology can analyze vast amounts of data to identify patterns and trends, helping sales teams to anticipate client needs and tailor their approach. For instance, AI-driven insights can highlight which financial products are most likely to appeal to specific client segments, enabling more targeted and effective sales strategies.

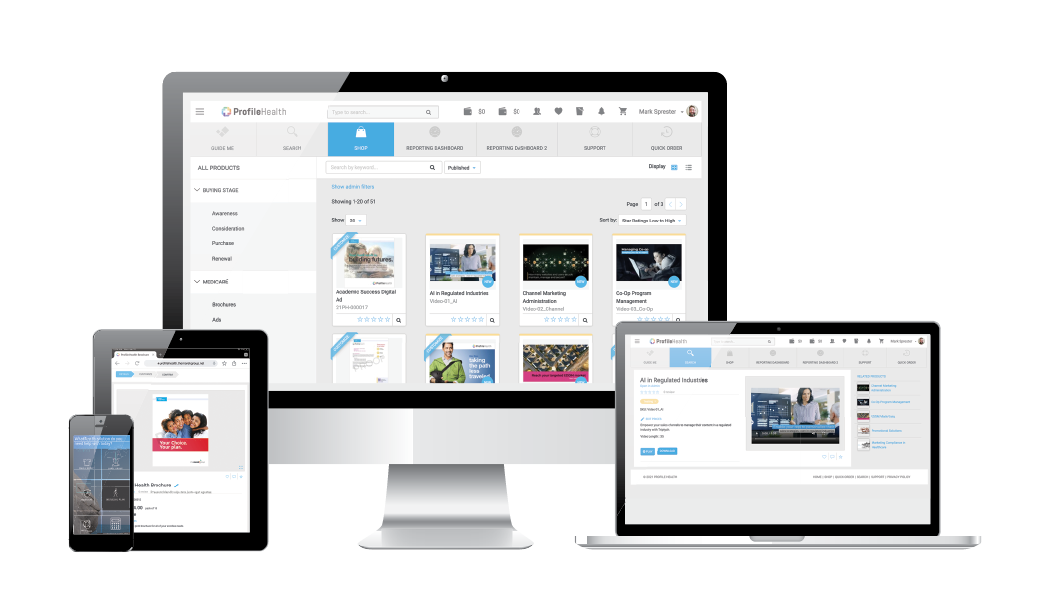

3. Sales Enablement Platforms: Integrated Solutions

Dedicated sales enablement platforms offer integrated solutions that bring together content management, training modules, and analytics. These platforms ensure that sales teams have easy access to up-to-date materials, such as product brochures and case studies. For financial services, where regulatory requirements are constantly changing, having a centralized repository of compliant content is essential for maintaining accuracy and trust.

4. Communication Tools: Enhancing Client Interactions

Technology has significantly improved the way financial advisors communicate with clients. Video conferencing tools, chatbots, and secure messaging platforms enable real-time, convenient interactions. These tools not only enhance the client experience but also allow for efficient collaboration within sales teams. For example, a financial advisor can use a secure messaging platform to quickly share documents with a client while maintaining compliance with data protection regulations.

5. Data Analytics: Measuring Success

The ability to measure the effectiveness of sales strategies is a key benefit of technology in sales enablement. Advanced data analytics tools provide detailed reports on sales performance, client engagement, and campaign success. Financial institutions can use these insights to refine their sales approaches, identify areas for improvement, and optimize their overall strategy. By leveraging data-driven decision-making, financial services companies can achieve better outcomes and drive growth.

Benefits of Technology in Sales Enablement

- Increased Efficiency: Automation of routine tasks allows sales teams to focus on high-value activities, such as building client relationships and closing deals.

- Enhanced Personalization: Technology enables a deeper understanding of client needs, allowing for more personalized and relevant interactions.

- Improved Compliance: Centralized content management and secure communication tools help ensure adherence to regulatory requirements.

- Data-Driven Insights: Access to real-time data and analytics allows for continuous improvement and more informed decision-making.

- Scalability: Technology solutions can easily scale to accommodate growing sales teams and expanding client bases.

The integration of technology into sales enablement is transforming the financial services industry. By leveraging CRM systems, AI, sales enablement platforms, and advanced communication and analytics tools, financial institutions can enhance their sales processes, improve client interactions, and drive growth.

As technology continues to evolve, the potential for further innovation in sales enablement is vast, promising even greater efficiency and effectiveness in the future.

At Triptych, we are dedicated to providing cutting-edge solutions that empower financial services companies to excel in their sales enablement efforts while ensuring strict compliance with regulatory requirements. This commitment helps our clients stay ahead in a competitive market with confidence and peace of mind.

How Sales Enablement Transforms Financial Services: Streamlining Processes with Triptych

In the highly competitive financial services sector, sales teams are under constant pressure to meet targets and drive growth. The ability to...

What’s the future of sales support in a sales-driven organization?

“Never take your eyes off the cash flow because it’s the lifeblood of business.”—Sir Richard Branson Cashflow matters. In fact, it’s one of the ...